How To Trade Divergence By Technical Indicators Divergence is a method employed in the field of technical analysis when the direction of a specific technical indicator (usually an oscillator) is different from the overall trend in price. This means that the indicator begins moving in the opposite direction to the price. The trading oscillator indicates a potential trend reversal.

How Does The Concept Of Divergence In Trading Function? Day traders view the change in direction as an indication of what price may be following. In this case, the oscillator is used as a leading indicator for the price. Divergence is utilized to study the market price because the indicator shows a slowdown of momentum. The price can often show an increase in momentum prior to the price. Think of it like you throw a Frisbee in strong wind. It will move against the wind for some period of time, before slowing. Then it will take off with the wind. Read the top

RSI divergence for website recommendations including zt crypto app, crypto app buy, yield farming crypto app, crypto app in nigeria, omi crypto app, cryptocurrency app best, crypto app wallet, crypto app on mac, 8pay crypto price prediction, my crypto app is not working, and more.

Which Indicator Is The Most Suitable For Determining Divergence

Which Indicator Is The Most Suitable For Determining Divergence There is no perfect indicator to determine the degree of divergence in trading. Every indicator that is technical has its advantages and disadvantages. We will discuss the three most commonly used indicators: RSI, MACD & Stochastic.

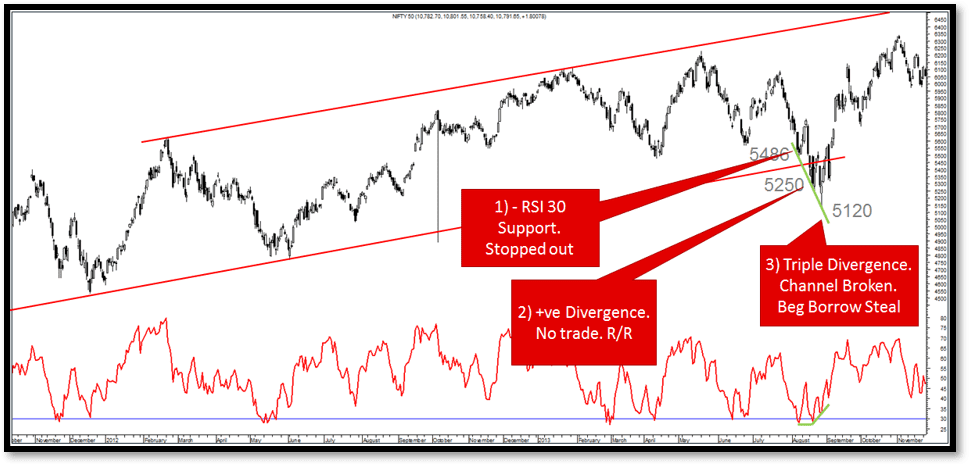

Rsi Is Used To Detect The Divergence Of Trading The RSI indicator displays the momentum indicator. It's displayed as an oscillator (between zero and 100) under the candlestick diagram, which is known as an indicator underlay. The RSI calculation is performed by adding the gains in price to losses from the previous 14 periods. J. Welles Wilder Jr. created it. It's a straight line that follows the trend of price. This indicator is suited well for divergence trading. If you set it to the default setting of 14-periods, the RSI indicator gives few overbought and oversold readings. In the case of divergence as a signal for trading, they tend to give fewer signals but are more stable when they do occur. Take a look at most popular

crypto backtesting for site examples including crypto app best, best app to track your crypto portfolio, virtual bitcoin app, can you buy crypto on cash app, crypto app error when buying, sun crypto app, bitcoin app available in germany, crypto app vs exchange, crypto.com app 12 word phrase, crypto app canada, and more.

MACD for divergence trading MACD is an indicator of momentum that is most useful when it comes to following trends. The trend indicator plots an indicator and a histogram, which shows the difference between moving averages. Moving averages will begin to converge and diverge as the trend advances and then reverse. While the histogram's visual appeal lends itself to trade divergence, it is more difficult to interpret when there is a new "swing point" has been identified. There isn't a predefined area of overbought or oversold in the MACD so deciding which trend trading signals are reliable enough to utilize is more challenging. It is possible to overcome this by making use of MACD past peaks to your advantage as zones of resistance and support. MACD is used only in trending situations, so it won't give any false signals against trends.

Stochastic To Reduce Divergence In Trading Stochastic, a momentum technical indicator is a technical indicator that compares the closing price to the price range from the previous 14 periods. The stochastic indicator is more sensitive and offer more trading opportunities, however it also provides more false signals. Read the most popular

best forex trading platform for blog advice including bitcoin app, bitcoin app singapore, xrp crypto app, official bitcoin app ios, crypto.com app jailbreak bypass, crypto app reddit, bitcoin app safe, bitcoin app for india, which bitcoin app works in egypt, best crypto app canada reddit, and more.

How Do You Confirm Divergence

How Do You Confirm Divergence Sure, but only infrequently! Indicators are a way to filter price action, and it is important to keep this in mind. That filter can help us concentrate on the most important aspects or miss what's important according to the trade setup. Divergence is an excellent signal for trading to help time your trade entry. It provides you with the signal prior to when the trend shifts. This signal can be used early to enable traders to set a higher cost for entry to their trade. But, it is possible for divergence to give false signals. This happens when the direction of an indicator changes, but the price trend doesn't reverse in the manner that the indicator indicates. This will quite often happen when the indicator is either overbought or undersold. While the momentum of a trend will be slowed, the trend will remain in place.

What Can You Do To Prove That There Is A Divergence? There are proven techniques which can cut down on false signals, and maximize the profitability of trading. You should only take divergence signals that point in the direction of the long-term trend. You can also opt for a rangebound sideways. If you are in a bear or bull market, do not rely on RSI signals. However, RSI signals can be used to indicate that you're looking to purchase. Be patient and wait for the candle to confirm the divergence. The state of the candle can be used to determine whether an indicator is showing signals. A signal for trading from volatility can disappear quickly if the candle's closing times differ. You can use other indicators to verify the signal like levels of support and resistance or pivot points, round numbers or a price-action trading pattern. Then, you can select RSI or MACD from the options. The indicator will now appear in the chart. You can then adjust its settings. To remove an indicator, click the Arrow and then move it from Active to All. See the top

bot for crypto trading for website info including etoro crypto app, korea crypto app, crypto quant app, no fee crypto app, rain crypto app, crypto journal app, useless crypto app, bitcoin app for iphone, paypal crypto app, best bitcoin earning app 2020, and more.

What happens when What happens when Divergence is not working?

What happens when What happens when Divergence is not working? Just as with any other technique for trading Divergence isn't a perfect solution 100% of the time. The most common time that the divergence method fails is in highly trending markets. If you take way too much divergence trades in the midst of a trend that is strong then you could suffer a significant loss. This is why it's important to have a well-constructed financial plan. It's crucial to know when you're in an underlying pattern and have the 2-strikes strategy to reduce losses. Your exit strategy as well as your execution speed and your capacity to analyze trades in a objective manner are all aspects that affect your winning rate. The most typical reasons for failures of any trading strategy are: inadequate testing or giving up too quickly, not recording your trades correctly or the strategy failing to have an advantage, having unrealistic expectations, not knowing your expected numbers, and missing out on good trading chances. These are all problems that could be the result of your trading psychology. So, if you've got one of the trading strategies that has an edge and you're in a losing run It's the time to look at your method and your psychology. Do not alter your approach simply because you're on losing streaks. There may not be an issue in your trading method. Examine your elements of trading objectively. See the top

best forex trading platform for website advice including zion bitcoin app, pakistan bitcoin app, crypto app portfolio, viral crypto app, bitcoin app in india, crypto app coin, 1 inch crypto app, bitcoin app that accept ach, virtual bitcoin app, bitcoin app elon musk, and more.

Do I Have To Trade Using Divergence? Divergence in trading, as a summary it can be an effective addition to your trading strategy in particular if you employ indicators like RSI and MACD to detect overbought or oversold levels. But it is important to note that it can not be answered by itself. It takes practice to master.